NCI Market Update Webinar Series: Special Edition | Featuring Zsolt Vincze

Zsolt Vincze, Senior Vice President at R.J. O’Brien & Associates

The Northern Crops Institute (NCI) hosted another monthly Market Update on December 7th, 2022. This month’s Special Edition webinar featured speaker Zsolt Vincze, Senior Vice President at R.J. O’Brien & Associates. He provided an update on the current Russia-Ukraine situation, and how it continues to impact commodity markets and production in the two countries.

Vincze started by discussing the average production and export shares for each of the major commodities over the 2017-2021. During this time, wheat exports were led by Russia (Ukraine’s was lowest) and wheat production was led by China (Ukraine’s was, once again, the lowest). For corn, exports were led by the U.S. (Russia was the lowest) and production was led, once again, by the U.S. (this time, China was the lowest).

Barley saw the European Union lead both exports and production, with Canada and Argentina having the lowest level of exports and production, respectively. Soybean production and exports were led by Brazil, with the Ukraine and China having the lowest level of production and exports, respectively. Finally, sunflower oil was exported and produced the most by Ukraine, and Turkey exported and produced the least.

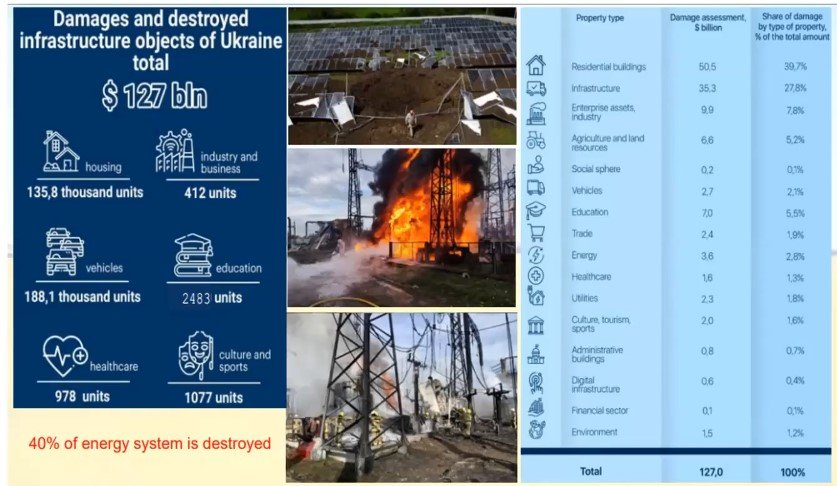

Damage and associated costs in Ukraine caused by the Russia-Ukraine Conflict.

Once he introduced that background information, Vincze pivoted to discussing the elephant in the room: the damages in Ukraine caused by the ongoing conflict so far. With 40% of the energy system in the country destroyed and numerous buildings and other infrastructure damaged or entirely destroyed in cities all over the country, the estimated cost of the entire damages is $127 billion and counting. This conflict has been especially hard on Ukraine’s agriculture capabilities, resulting in over $6.9 billion worth of damages being done to their agriculture supply chain. Additionally, 22% of Ukraine’s farmland are now under Russian control, further dampening their potential.

There are numerous other impacts this conflict is having in the country. Vincze cited excerpts from an interview conducted with a large commercial farm manager on November 30th, where the farmer described conditions such as high equipment prices (with unstable delivery times), an unprofitable livestock industry, generators quickly becoming a necessity to keep machines running, and so on. The progress of field work has also slowed down considerably due to the effects of the conflict, though there are a few bright spots with respect to this slowdown.

Russia’s GDP, July 2019-July 2022.

This conflict’s effects aren’t just limited to Ukraine, though. They’re having an impact on Russia, as well. For example, Russia’s GDP took a strong hit right when their invasion of Ukraine began. While it has since recovered to a certain degree, it still remains far below what it was even just one year ago. This has affected Russia’s overall strength as a global superpower, among other effects. These effects include a general decline in their production of commodities, too (though, it’s to a much lesser degree and due to other factors besides the conflict, like unfavorable weather patterns). And, unlike Ukraine, there are signs of an increase in production thanks to improving weather and harvesting resuming at a normal pace.

We at the Northern Crops Institute greatly appreciate Zsolt Vincze’s involvement and input in our webinar. At NCI, we continue to work towards fulfilling our mission of supporting regional agriculture and value-added processing by conducting educational and technical programs that expand and maintain domestic and international markets for northern grown crops. All of this wouldn’t be possible without the innovative ideas of guest speakers like Vincze.

For more information about future webinars offered at NCI, click here.

To watch the recording, click the video below.